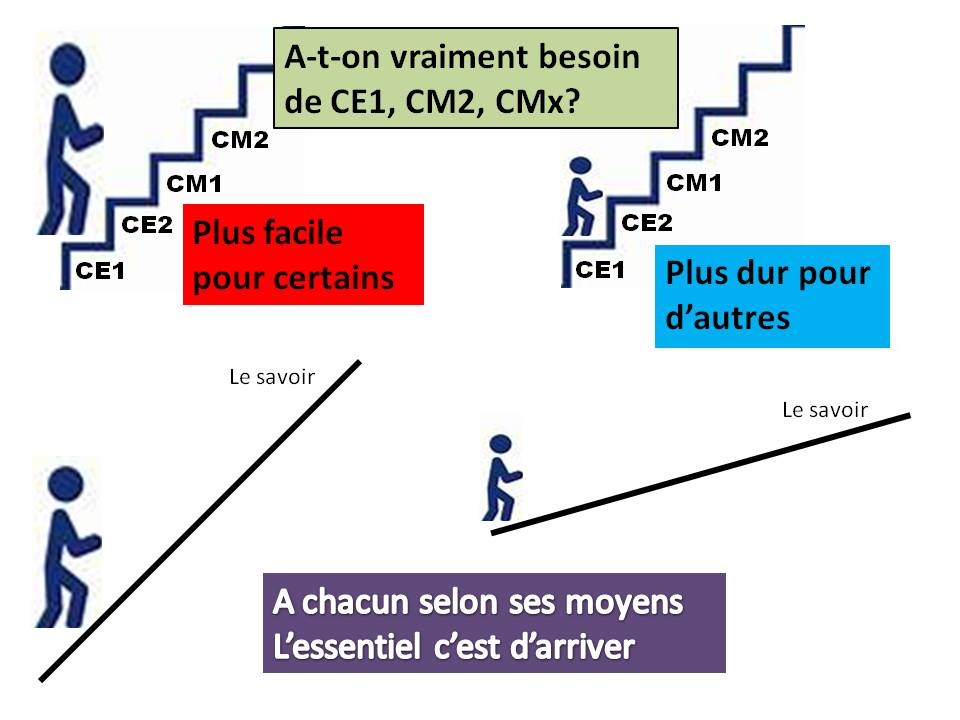

Cette image illustre comment on met dans les memes conditions alors qu'ils sont fondamentalement differents. Ils se retrouvent dans la meme classe tout simplement parce qu'ils sont nes la meme annee, ce qui est loin de garantir qu'ils aient les memes dispositions intellectuelles, mentales, psychologiques socio-economique. A chacun selon ses possibilites. La contrainte auto-imposee que tout le monde finisse le programme le meme jour ne repose sur rien de rationnel, juste un autre example d'arbitraitre